FOODCHEM

Share:

Notícias

Consumption of high-intensity sweeteners worldwide

High-intensity sweeteners (HIS) are a structurally diverse set of compounds that share an important attribute: all are much sweeter than sucrose (table sugar). Unlike sugar, HIS are noncaloric and noncariogenic (they do not contribute to dental caries). Most HIS—including acesulfame K, aspartame, cyclamate, saccharin, and sucralose—are artificial sweeteners, produced by chemical synthesis; a few, including stevia extract, are natural products.

Worldwide consumption of HIS is largely dependent on production of diet carbonated soft drinks and food. Beverages make up the majority of world HIS consumption, followed by food, tabletop sweeteners, personal care products (such as toothpaste and mouthwash), and pharmaceuticals.

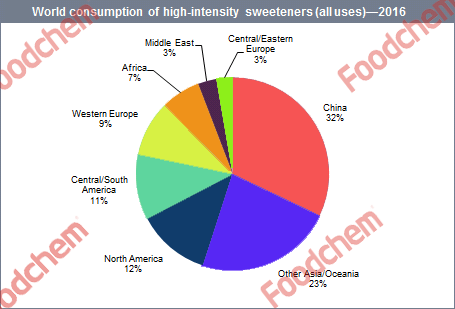

The following pie chart shows world consumption of high-intensity sweeteners in 2016:

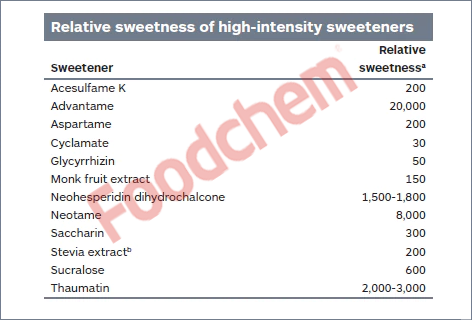

The following table shows the relative sweetness of various high-intensity sweeteners relative to sucrose (table sugar), which is the “gold standard” of sweetness (sugar or sucrose = 1):

The outlook for high-intensity sweetener consumption during 2016–21 varies by region and by sweetener. Demand for mature HIS—cyclamate, saccharin, and aspartame—is flat or declining in North America and Western Europe although consumption continues to increase in Asia, the Middle East, and Africa. In contrast, consumption of acesulfame K, sucralose, and stevia extract is growing in all regions.

Cyclamate was the leading sweetener in terms of consumption volume, responsible for almost half of global HIS consumption in 2016. Because cyclamate is only 30 times as sweet as sucrose, however, it accounted for just 10% of sucrose equivalents. Saccharin, which is 300 times as sweet as sucrose, was third with respect to consumption volume but first in terms of sucrose equivalents. Saccharin accounted for 37% of total sucrose equivalents in 2016.

Developing regions, including notably Asia and Africa, accounted for the bulk of world cyclamate consumption in 2016. The use of cyclamate—the least expensive high-intensity sweetener—in these regions has increased as diet beverages and food have become more popular for health reasons. Africa and Asia are among the regions that expect to see above-average growth in cyclamate consumption during 2016–21. In contrast, cyclamate consumption is predicted to decrease in the Americas and Europe. (Cyclamate use in foods is prohibited in the United States, Japan, and South Korea.)

The Americas accounted for more than 40% of world aspartame consumption in 2016, with demand driven largely by diet soft drink production. Ongoing declines in soft drink consumption and consumer concerns about the sweetener’s safety will lead to declines in North America and Western Europe during 2016–21. In contrast, aspartame consumption is expected to grow at above-average rates in Central and South America, China, Other Asia and Oceania, Africa, and the Middle East. Aspartame accounts for approximately 18% of the world consumption of HIS (sweetening uses only).

Asia accounted for more than half of world saccharin consumption in 2016. Saccharin is a mature product with a broad range of uses. It serves as a sugar replacement in foods and beverages; in addition, its sweetness masks the bitter taste of other ingredients in personal care products (toothpaste, mouthwash) and pharmaceuticals. Smaller end uses include animal feed and electroplating. China, Other Asia and Oceania, Africa, and the Middle East are expected to see aboveaverage growth in saccharin consumption during 2016–21. In contrast, saccharin consumption is predicted to decrease in the Americas and Europe. Saccharin accounts for approximately 18% of the world consumption of HIS (sweetening uses only).

Asia and the Americas were responsible for the bulk of world acesulfame K consumption in 2016. Acesulfame K is typically used in combination with aspartame and sucralose; acesulfame K/aspartame and acesulfame K/sucralose blends have very appealing sucroselike taste profiles. All regions are expected to see positive consumption growth during 2016–21, with especially vigorous growth in China and Central and South America. Acesulfame K accounts for approximately 9% of the world consumption of HIS (sweetening uses only).

North America was the single largest consumer of sucralose in 2016, followed by China. Sucralose, which is 600 times as sweet as sucrose, has an appealing sugarlike taste profile. All regions are expected to see increases in consumption during 2016–21, with especially vigorous growth (from a very small base) in Africa and the Middle East.

The Americas and Asia accounted for most of the consumption of stevia extract in 2016. The stevia plant, which is the source of stevia extract, is indigenous to South America; today, however, the bulk of cultivation takes place in China. Japan, China, and other Asian countries have long used stevia extracts as sweeteners; European, Middle Eastern, and African markets for this sweetener are comparatively developmental. Consumption of stevia extract is expected to increase at a higher rate than that of other HIS during 2016–21, largely because of consumer preferences for natural sweeteners.

see our high-intensity sweeteners products:

http://www.foodchem.cn/index.php?main_page=search&keyword=Compound+Sweetener+&submit=submit