FOODCHEM

Share:

Notícias

Animal Feed Additives Market size

Animal Feed Additives Market size was above USD 16.5 billion in 2016 and should witness significant gains to surpass 5.5 million tons during forecast timeframe.

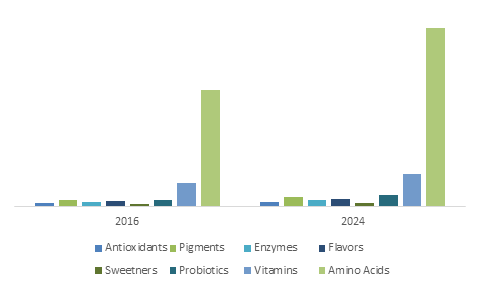

China Animal Feed Additives Market Size, By Product, 2016 & 2024 (USD Million)

Growing concerns for safety & quality of meat and meat products owing to numerous disease outbreaks in livestock including foot & mouth infections, bird flu and swine flu in past decade should drive global animal feed additives market size. Surge in consumption of meat products owing to rising consumer per capita income along with shift in consumer food behavior towards protein rich diet should further strengthen industry growth.

Global feed production surpassed 1,000 million tons in 2016. Asia Pacific witnessed highest production and accounts for over 350 million tons in 2016. Growth in livestock production for meat consumption accompanied with government initiatives such as schemes and subsidies promoting livestock health and production may drive industry growth in this region.

Livestock need ample energy source for essential life processes which includes muscular activity. Feed provides all essential nutrients and high fiber content such as proteins, carbohydrates & fats, vitamins and growth stimulants thereby increasing digestive metabolism, efficiency, growth and immunity mainly in young livestock.

These additives enhance yield & quality of feed resulting enhanced animal performance and health. China meat consumption exceeded 50 kilo tons in 2016 and should surpass 60 kilo tons by 2024. Increasing meat product consumption in China, Malaysia, India and Thailand due to high livestock production and efficient distribution network through retail stores and supermarkets should stimulate industry growth.

Strict regulatory regimes regarding ban on antibiotics or antibiotic growth promoters (AGPs) in U.S and Europe owing to bioaccumulation of antibiotics in gastrointestinal tract creates resistance to medicines. Thus, should boost market for replacements with natural growth promoters like probiotics, antioxidants and amino acids. Increased government interventions in food & feed safety with rising investments, laying forth policies and regulations to standardize meat products should drive product demand.

Positive outlook for increasing investments & financial assistance for livestock farming as supplementary business as agriculture for catering growing meat demand & supportive technological innovations in processing equipment should drive animal feed additives demand. Growing emphasis on livestock nutrition for providing quality meat products is rising to its utmost importance to support consumer health & diet which should positively influence product demand.

Global packaged food & beverage industry is expected to surpass USD 3 trillion by 2024. Strong global demand for packaged meat & meat products by consumers owing to busy work schedule and increasing disposable income. Development of new technology along with constant improvement in finished products will steer industry growth. Growing life expectancy, limited availability of water and optimal feed utilization in meat industry should further strengthen product demand.

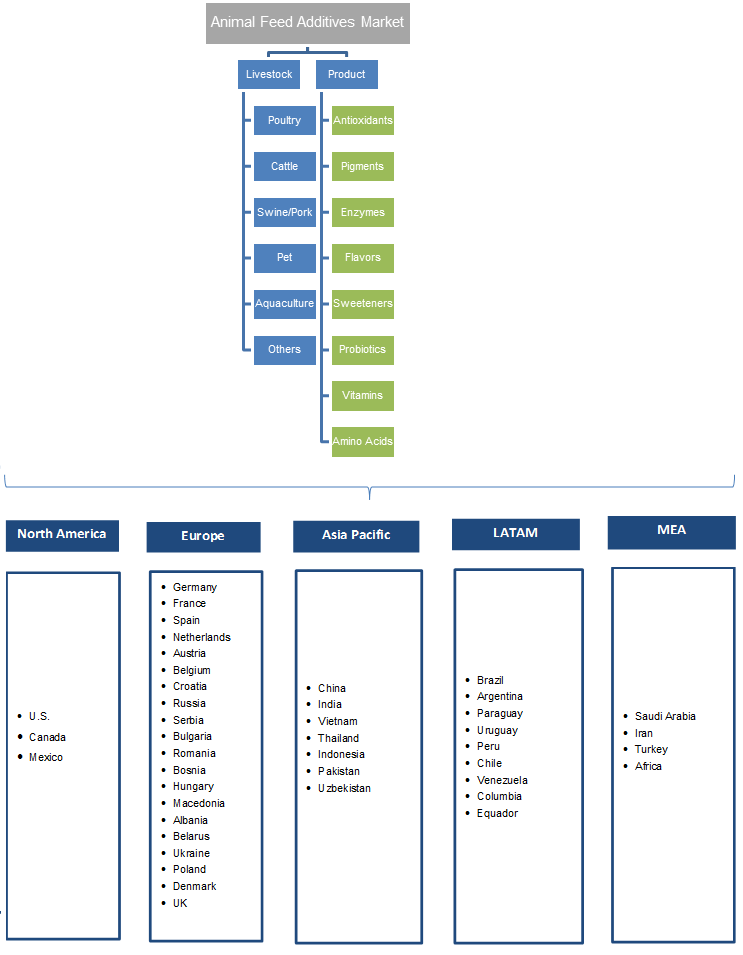

Animal Feed Additives Market, By Livestock

Animal feed additives market size from poultry application should surpass USD 10 billion by 2024. These products play a significant role in poultry diets to improve growth efficiency and laying capacity. Improvement in nutritional management techniques along with development in technology for animal breeding should favor product demand for poultry production applications.

Animal feed additives industry demand from cattle application should witness significant gains at over 4% during forecast period. It improves cattle digestive and health system along with lowering input cost compared to output by regulating pH levels, metabolism and providing vital nutrients for optimum growth externally. China, India and Brazil are accounted for highest production owing to production cost benefits, high overseas & domestic demand.

Animal feed additives market size from swine application will grow at over 3.5% by 2024 owing to increasing demand for high-quality pork, growing income of middle class population and need to meet demand-supply gap. These positive attributes towards livestock industry should propel product demand.

Animal Feed Additives Market, By Product

Global antioxidant feed additives market size should generate revenues surpassing USD 550 million by 2024. This growth in demand can be attribute to its extensive application scope in livestock including poultry, cattle, swine, pet and aquaculture. Antioxidants protects processed food products from cytotoxin formation. It also protects feed ingredients from oxidation which results rancidity of fats destruction of vitamins A, D and E.

Amino acids based animal feed additives market size should witness gains at over 3.5% during forecast timeframe. Major amino acids for animal nutrition n includes lysine, methionine, thiamine and tryptophan. Lysine is widely used as growth promoters for cattle and swine driving global demand. Lysine also offers nutritional value equivalent to soybean providing economic alternative animal feed additives.

Global pigment feed additives market size should surpass USD 950 million by 2024 owing to its wide benefits in animal nutrition. It contains spirulina, carotenoids & curcumin and widely used on poultry, swine and ruminants owing to their antioxidant features. Carotenoids are often used as additives to improve color to salmon, chicken, butter and egg yolk. Increasing demand for seafood, chicken and eggs should stipulate market size.

Global vitamins feed additive market size will exhibit steady growth rates during projected period. Growing demand for vitamins in livestock nutrition industry is expected to surpass 250 kilo tons by 2024. This product segment comprises of vitamin A, C, D, E, K, B1, B2, B6, B12, biotin, folic acid, niacin and caplan. Vitamin E comprises is the most widely consumed product in this category due to its ability to improve stability, dispersion, compatibility and handling characteristics for feed fortification.

Global enzymes feed additives industry size will witness significant growth during forecast period. This demand growth should be attributed to its ability to enhance biochemical & chemical reactions improving metabolism mainly in swine and poultry. Non-starch polysaccharides such as arabinoxylan, cellulose, mannan and beta-glucan helps in enhancing digestive health and nutritional value of birds and other poultries. It catalyzes specific chemical reactions and regulates digestive mechanism in animals driving product demand.

Animal Feed Additives Market, By Region

Europe animal feed additives market size led by Germany, France and UK should witness growth at over 3.5% owing to its strong application outlook in livestock industry. Stringent regulatory regime pertaining to ban for antibiotic growth promoters (AGPs) should bolster demand for natural growth promoters (NGPs) driving industry growth.

U.S. animal feed additives market demand should exceed USD 3.5 billion by 2024 due to extensive demand for meat and meat products from swine, cattle and poultry in its food industry. Strong economic foothold along with busy work schedule for consumers should drive product demand.

Latin America, driven by Brazil and Argentina animal feed additives market size, should witness gains at over 4% during projected period. This growth could be ascribed to increasing investment in agribusiness along with government initiatives to encourage agriculture owing to need for maintaining nutrition & health in livestock and should boost industry growth.

Russia animal feed additives market is also anticipated to show strong growth rates during forecast timeframe owing to high regional production and consumption rates. Shift in consumption pattern from traditional foods to meat products should propel industry growth.

Competitive Market Share

Global animal feed additives market share is highly competitive & moderately consolidated with industry participants including Alltech, ADM, Dr. Eckel, Biomin, Dr. Eckel, Impextraco, Kemin Industries, Novus International, DSM, BASF SE, Cargill, Nutreco, Miavit and Kaeslar.

Industry participants are investing in product development and customization to improve efficacy and productivity. Companies also focus on frequent mergers & acquisitions as an attempt to diversify product portfolio and expand regional presence. In December 2016, Alltech acquired Tecnicas Ibericas De Alimentacion Animal an animal feed premix plant and warehouse in Almoguera, Spain. The acquisition made was to strengthen its presence and production capacity, providing advanced nutritional technology and impart greater value to producers in Spain.

Animal Feed Additives Industry Background

Animal feed additives are the food supplements for farm animals for improving feed quality along with quality of food from animal origin and enhance animal performance and health. It includes amino acids, vitamins, antioxidants, flavors, pigments, and probiotics for poultry, swine, aquaculture, pets and cattle. Four general types of feed additives include zootechnical additives, nutritional additives, sensory additives and coccidiostats and histomonostats.

Feed products are needed to be approved by various food & feed safety agencies including FFDCA, FDA and European Commission. In the U.S. feed additives need to be cleared by GRAS recognizing additives to be fit for consumption. Approved feed additives are listed in 21 CFR 573 and 579.